Job numbers are poor, and the stimulus that wasn't big enough in the first place has been spent.

We're still in a liquidity trap, as this chart from Greg Mankiw illustrates what the interest rate should be, compared to what it is.

(That leveling out in the past year is right around a federal interest rate of zero, hence the trap.) A corporatist drumbeat is beginning that we should start to raise the interest rate, out of fear of inflation, even though that isn't really a risk at all right now, deflation is.

Likewise, the tea party and libertarians don't want any more stimulus because they think we're too far in debt already, (though no one actually wants to cut anything from the budget, and taxes are of course anathema) but it's pretty easily demonstrated that we can handle more debt than we already have.

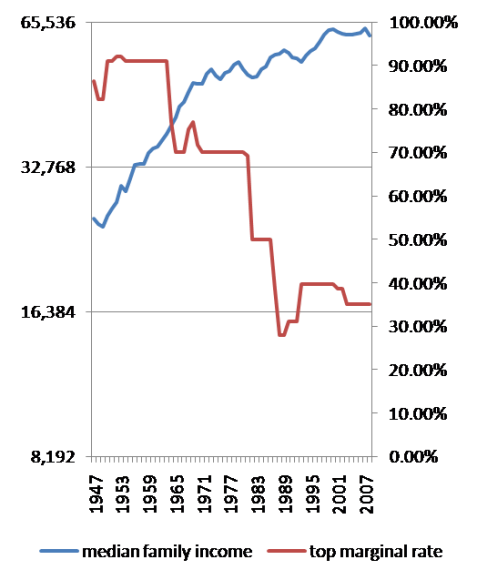

Not that we'd even have too big a problem raising taxes now, because the top income tax rate has never been lower (not that income tax is the only reasonable means for revenue, as frequent readers may note). And, contrary to the corporatist drumbeat, it would likely have an expansionary effect, as Paul Krugman's chart to the right shows, a high top income tax rate has the greatest rate of expansion, and that if you lower taxes on the rich, growth slows, i.e., Ayn Rand was way wrong about that Galt character.

In the short term, we need more stimulus immediately. It should be paid for shortly thereafter by higher taxes – on high income for expansion and upward mobility, and on land and carbon to save the planet and improve our lives. Robert Gibbs could say something like this.

In the long term, I'm not sure we could survive without an entirely new economic system.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment