Tuesday, January 26, 2010

Monday, January 25, 2010

Is the bill unpopular, or just what we THINK the bill is?

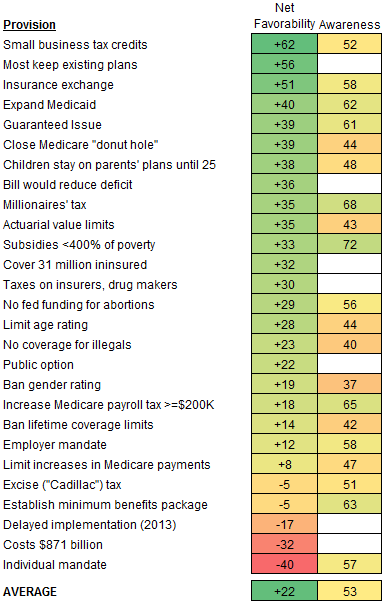

Nate Silver has a great illustration of the fact that people have a tendency to dislike the bill without knowing what's actually in it:

It should also be noted that the least popular part of the package, the mandate, is required to accompany the many popular reforms. If we enforce that insurers cannot deny coverage for preexisting conditions, then there is no incentive for everyone to go without coverage until they need it. It's also an important part of how to keep premiums down in the long run.

This is to serve as a more substantial explanation of why I stated that those who are interested in reform at all agree the bill should be passed. I suppose another qualifier – in addition to "interest in health reform" – should be "knowing what's in the bill."

It should also be noted that the least popular part of the package, the mandate, is required to accompany the many popular reforms. If we enforce that insurers cannot deny coverage for preexisting conditions, then there is no incentive for everyone to go without coverage until they need it. It's also an important part of how to keep premiums down in the long run.

This is to serve as a more substantial explanation of why I stated that those who are interested in reform at all agree the bill should be passed. I suppose another qualifier – in addition to "interest in health reform" – should be "knowing what's in the bill."

Friday, January 22, 2010

Other Ways to Fix Health Care

After the Massachusetts special election, it seems that many have picked up the narrative that any progressive agenda will have to be scaled back, in particular with the current battle for health care reform. This argument presupposes that the nation's disapproval of the bill is a result of it being too progressive in the first place, rather than being too much of a toothless compromise. (This argument also presupposes that the election results were indicative of the attitude of the nation, whereas it's worth noting that the state already has a form of universal coverage, and Martha Coakley insulted the Red Sox).

Most who are interested in health reform at all agree that the Senate bill would be better for the nation's welfare than no bill, and if that's the only politically viable option, we should pass it. But at the moment there seems to be a news-cycle-zeitgeist of reconsidering options, and thus I'd like to propose a few.

The argument that could be made is that this merely shifts a chunk from one budget line to another. Though this is partially true, it is important to note that this would mean that paying the doctor is no longer a reason for health insurance companies to inflate premiums, and it would also mean that education would be paid for on time, rather than with interest.

When the nation subsidizes corn production, it means that foods whose calories come largely from HFCS are cheaper for consumers, and they have incentive to put themselves at risk for conditions such as diabetes. When livestock with a heavy ecological footprint such as cattle are also associated with heart disease risk when consumed heavily, internalizing the cost of the heavy foot print incentivizes both a healthier eater and healthier planet. Likewise, any time one chooses to bike to the store instead of drive, they do the same service to themselves and their environment, which returns the favor with cleaner air and reduced lung cancer risk.

In short, preventative care that works and is actually incentivized.

It should be reiterated that there are very important reforms already included in the health care bill, such as disallowing rescissions and ensuring coverage for pre-existing conditions. These provisions should be made law immediately. I offer these in addition merely as things to consider when it seems like our only options have been dashed by the Coakleys and Liebermans of the world.

Most who are interested in health reform at all agree that the Senate bill would be better for the nation's welfare than no bill, and if that's the only politically viable option, we should pass it. But at the moment there seems to be a news-cycle-zeitgeist of reconsidering options, and thus I'd like to propose a few.

1. Medical education should be fully Federally subsidized.

One reason that health care costs are higher in the United States for similar care in other industrialized nations is merely that we pay our doctors far more. A major justification for this is that doctors in the United States generally have to pay their own way through medical school with loans that are repaid through their careers. When you remove the cost of repaying medical school loans, American doctor salaries fall back to a comparable level. Still higher, but comparable.The argument that could be made is that this merely shifts a chunk from one budget line to another. Though this is partially true, it is important to note that this would mean that paying the doctor is no longer a reason for health insurance companies to inflate premiums, and it would also mean that education would be paid for on time, rather than with interest.

2. Medical schools should accept more students. A lot more.

The quantity of new doctors entering the labor market in the US is generally fixed. The AAMC accredits 131 medical schools in the nation, and class sizes don't vary that much. In any other labor market, the high salary of the profession would attract more people to pursue that profession. With a fixed barrier to entry, the effect is that the salary stays high – but doctors work exhaustively long hours, with paradoxically limited time to spend with each patient. With more doctors entering the labor force, we will see their hours return to a manageable amount, patients will have more time with them, and their pay will come back down to earth.3. End agricultural subsidies, tax fossil fuels.

When doctors refer to "preventative care," they tend to refer to early detection and evaluating patient risk for illness. Generally, it refers to things that occur in the doctor's office, with little mention of what the patient does outside. What effect, however, is nutritional counselling with a doctor once a year going to have in comparison to the fact that every day in grocery stores naturally produced foods can cost more than twice as much as their artificially produced equivalents. Somehow in our national discussion of health care, we've completely neglected the incentives that individuals have to eat artificially manufactured foods and avoid exercise.When the nation subsidizes corn production, it means that foods whose calories come largely from HFCS are cheaper for consumers, and they have incentive to put themselves at risk for conditions such as diabetes. When livestock with a heavy ecological footprint such as cattle are also associated with heart disease risk when consumed heavily, internalizing the cost of the heavy foot print incentivizes both a healthier eater and healthier planet. Likewise, any time one chooses to bike to the store instead of drive, they do the same service to themselves and their environment, which returns the favor with cleaner air and reduced lung cancer risk.

In short, preventative care that works and is actually incentivized.

It should be reiterated that there are very important reforms already included in the health care bill, such as disallowing rescissions and ensuring coverage for pre-existing conditions. These provisions should be made law immediately. I offer these in addition merely as things to consider when it seems like our only options have been dashed by the Coakleys and Liebermans of the world.

Wednesday, January 20, 2010

Similar numbers to Smart Growth's earlier report were released by the CBO, and Paul Krugman has a chart:

If you're unfamiliar with Keynesian economics altogether, you're probably the one complaining about the fact that the government is being silly enough to go into debt in a recession. But, if you agree with the premise that deficit spending is one of the major ways to stimulate an economy in hard times, you'll find the numbers kind of interesting.

The common liberal drumbeat is that government spending will have a greater effect (i.e., a larger fiscal multiplier) on the economy. The common conservative retort is that a tax cut will have a greater effect on boosting the economy. Taken as broad categories, most data supports the idea the government spending wins: when the government spends it, you know the money's spent; when it's returned, it might just sit in account. But as the chart above shows, if you break it down, there are some tax cuts that will do really well in boosting the economy, like the payroll taxes. Notice that capital gains, energy, and land are not on the list.

Of course, unemployment benefits tend to do very well, because it's a return to people who are nearly guaranteed to spend it, as they are in the greatest need. This is also why, contrary to trickle down theory, if you want to stimulate the economy with a tax break, give it to the poor, because they need to spend immediately on important needs. Give it to the rich, and they either sit on it, or perhaps send our economy in frivolous directions and make our work vapid.

If you're unfamiliar with Keynesian economics altogether, you're probably the one complaining about the fact that the government is being silly enough to go into debt in a recession. But, if you agree with the premise that deficit spending is one of the major ways to stimulate an economy in hard times, you'll find the numbers kind of interesting.

The common liberal drumbeat is that government spending will have a greater effect (i.e., a larger fiscal multiplier) on the economy. The common conservative retort is that a tax cut will have a greater effect on boosting the economy. Taken as broad categories, most data supports the idea the government spending wins: when the government spends it, you know the money's spent; when it's returned, it might just sit in account. But as the chart above shows, if you break it down, there are some tax cuts that will do really well in boosting the economy, like the payroll taxes. Notice that capital gains, energy, and land are not on the list.

Of course, unemployment benefits tend to do very well, because it's a return to people who are nearly guaranteed to spend it, as they are in the greatest need. This is also why, contrary to trickle down theory, if you want to stimulate the economy with a tax break, give it to the poor, because they need to spend immediately on important needs. Give it to the rich, and they either sit on it, or perhaps send our economy in frivolous directions and make our work vapid.

Tuesday, January 19, 2010

I guess sort of mandatory...

Thus, incidental uncharged disservices are rendered to third parties when the game-preserving activities of one occupier involve the overrunning of a neighbouring occupier’s land by rabbits...

via Krugman

Monday, January 11, 2010

Prop 13

Joe Klein responds to George Will:

Many things that a state would like to do for its citizens -- providing collective resources and services and the like -- require actual money. This requires some kind of taxes. But too often we neglect the power of targeting taxation in solving some of the problems that we would otherwise try to solve by funding government programs. Proposition 13 not only limited the state's revenue, but also guaranteed that the funds raised would be the problem-creating kind of taxation, not the problem-solving kind.

How on earth Will can write a column about the problems in California without even mentioning Proposition 13--the 1978 ballot measure that severely limited local property taxes--is beyond me. Prop 13 has distorted revenue gathering, severely limiting the amounts that localities can pay for schools and other public services, forcing the state to take on an increased burden.

Many things that a state would like to do for its citizens -- providing collective resources and services and the like -- require actual money. This requires some kind of taxes. But too often we neglect the power of targeting taxation in solving some of the problems that we would otherwise try to solve by funding government programs. Proposition 13 not only limited the state's revenue, but also guaranteed that the funds raised would be the problem-creating kind of taxation, not the problem-solving kind.

Wednesday, January 6, 2010

Paul Krugman:

There appears to be a regular right-wing talking point that environmentalism, as part of the liberal agenda, is intended to strangle businesses and reduce our standard of living. Disregarding the personal measures - for which the point would be that we should reconsider what energy use actually benefits our standard of living - and focusing on corporate-infrastructural measures, the point is that energy efficiency would actually benefit businesses.

This seems to be merely one of many problems stemming from the focus on short-term profitability rather than long-term longevity, which I'd presume stems from the increased speed with which an investor can shift investments. Not that investor convenience is the problem to be solved, we just need to address the major differences in the mindset of a publicly-traded company versus a privately-held small business.

While campaigning in 2008, the president suggested $250,000 as fairly arbitrary dividing point between small and large businesses -- and thusly made Samuel Joe Wurzelbacher famous. I would suggest that a much better dividing line would be whether a company is publicly traded. If you answer only to yourself and your customers, we call you a small business. If you answer in addition to a group of unrelated investors whose interest is only in profitability, you require a great deal more regulation.

Gayer doesn’t just have a logical problem; he appears to be unaware that there is a large economics literature on the subject of the energy-efficiency gap: the apparent failure of consumers and firms to take energy-saving measures that would actually save them money.

There appears to be a regular right-wing talking point that environmentalism, as part of the liberal agenda, is intended to strangle businesses and reduce our standard of living. Disregarding the personal measures - for which the point would be that we should reconsider what energy use actually benefits our standard of living - and focusing on corporate-infrastructural measures, the point is that energy efficiency would actually benefit businesses.

This seems to be merely one of many problems stemming from the focus on short-term profitability rather than long-term longevity, which I'd presume stems from the increased speed with which an investor can shift investments. Not that investor convenience is the problem to be solved, we just need to address the major differences in the mindset of a publicly-traded company versus a privately-held small business.

While campaigning in 2008, the president suggested $250,000 as fairly arbitrary dividing point between small and large businesses -- and thusly made Samuel Joe Wurzelbacher famous. I would suggest that a much better dividing line would be whether a company is publicly traded. If you answer only to yourself and your customers, we call you a small business. If you answer in addition to a group of unrelated investors whose interest is only in profitability, you require a great deal more regulation.

Tuesday, January 5, 2010

Subscribe to:

Posts (Atom)