Wednesday, June 30, 2010

Saturday, June 26, 2010

Are Stadiums Public Investments?

Stadium Status from Internets Celebrities on Vimeo.

There could be a number of reasons why a city would choose to build a new stadium for their sports franchise. Just be sure you don't mistake "economic development" for one of them. They are almost always a net loss for the public.

Friday, June 25, 2010

Personal Update (and a few non-personal)

Today is my final day at my current place of employment. This fall, I will be beginning this program, hopefully with a concentration in law, psychology, and human development.

My writing here, I've hoped, has addressed various issues at the intersection of human well-being and public policy. I anticipate that I will be studying and experiencing much more regarding the center point of that venn diagram, though perhaps particular topics might vary more, or I might find focus on other unanticipated subjects. I'm hoping you'll stick with me.

For example: Does our copyright law actually encourage artists to create? At the very least, copyright infringement doesn't appear to discourage it:

Of course, a site named after the founder of environmental economics will still continue to discuss such topics, perhaps merely with a very broad definition of both "environment" and "economics." Duly, you can pick up your free "Prosecute BP" sticker here.

Thanks, All.

My writing here, I've hoped, has addressed various issues at the intersection of human well-being and public policy. I anticipate that I will be studying and experiencing much more regarding the center point of that venn diagram, though perhaps particular topics might vary more, or I might find focus on other unanticipated subjects. I'm hoping you'll stick with me.

For example: Does our copyright law actually encourage artists to create? At the very least, copyright infringement doesn't appear to discourage it:

Yet, despite the popularity of the new technology, file sharing has not undermined the incentives of authors to produce new works. We argue that the effect of file sharing has been muted for three reasons. (1) The cannibalization of sales that is due to file sharing is more modest than many observers assume. Empirical work suggests that in music, no more than 20% of the recent decline in sales is due to sharing. (2) File sharing increases the demand for complements to protected works, raising, for instance, the demand for concerts and concert prices. The sale of more expensive complements has added to artists’ incomes. (3) In many creative industries, monetary incentives play a reduced role in motivating authors to remain creative. Data on the supply of new works are consistent with the argument that file sharing did not discourage authors and publishers. Since the advent of file sharing, the production of music, books, and movies has increased sharply.

Of course, a site named after the founder of environmental economics will still continue to discuss such topics, perhaps merely with a very broad definition of both "environment" and "economics." Duly, you can pick up your free "Prosecute BP" sticker here.

Thanks, All.

Thursday, June 24, 2010

Ugh

Oh, come on:

The federal judge who overturned Barack Obama's offshore drilling moratorium appears to own stock in numerous companies involved in the offshore oil industry – including Transocean, which leased the Deepwater Horizon drilling rig to BP prior to its April 20 explosion in the Gulf of Mexico-according to 2008 financial disclosure reports.

Incidentally, now that Jim Newell's at Gawker, does that lend him more or less credence than when writing for Wonkette?

(Image from NASA, who also has a 10MB hi-res.)

Wednesday, June 23, 2010

What would the accurate pigouvian tax be for alcohol consumption?

Erric Morris at the Freaknomics blog ponders:

This four dollars includes merely the societal effect, i.e., the externality:

Rather than merely considering it their own business, as we've discussed previously, it may be possible to incorporate our own "internalities" into the cost, i.e., raise the price of the product to adjust for our cognitive bias in evaluating our own futures and risks.

One author avaluated the effect of DUIs in proportion to societal effects of alcohol as a whole:

In fact, as previously mentioned, drunk driving crashes can be associated also with the cost of gasoline. It would be interesting to evaluate how these two prices, gas and alcohol, could synergistically conflate to reduce drunk driving. Which price has a greater impact on our cognitive biases? Do we tend to fill our tank before or after we've impaired our judgement?

In 1996, Donald S. Kenkel estimated that taxes would have to quadruple. Or, to think of it another way, taxes should about equal the price of the drink itself. Very roughly, this would hike the cost of a six pack of one of the mass-produced American beers from about $6.00 to about $10.00.

This four dollars includes merely the societal effect, i.e., the externality:

Many use alcohol responsibly, but one study found that thanks to DUI accidents, crime (impacts on victims, costs of policing, and costs of incarceration), shortened lifespans, medical and psychological care for drinkers, and impaired productivity, the total cost of alcohol abuse approaches $700 per American per year (about $860 in today’s dollars).

Who’s getting stuck with the tab? A large portion of the total cost falls on the drinkers themselves, which might reasonably be considered to be their own business. But much of the burden is also borne by drinkers’ families and friends, and by society as a whole.

Rather than merely considering it their own business, as we've discussed previously, it may be possible to incorporate our own "internalities" into the cost, i.e., raise the price of the product to adjust for our cognitive bias in evaluating our own futures and risks.

One author avaluated the effect of DUIs in proportion to societal effects of alcohol as a whole:

Kenkel estimated that if we could magically do away with DUI, we should still optimally raise taxes on alcohol (due to liquor’s other deleterious effects), but that the increase should only be about a dollar a six pack and not four dollars.

In fact, as previously mentioned, drunk driving crashes can be associated also with the cost of gasoline. It would be interesting to evaluate how these two prices, gas and alcohol, could synergistically conflate to reduce drunk driving. Which price has a greater impact on our cognitive biases? Do we tend to fill our tank before or after we've impaired our judgement?

Tuesday, June 22, 2010

Simplify, Simplify.

People are walking and biking more, perhaps thanks to some increased funding. From 1990 to 2009, the number of bike trips increased from 1.7 billion to 4 billion.

The New York Times has an excellent infographic illustrating that we've had a reduction in miles driven per year despite a lower gas price even though we typically only see such reductions when prices skyrocket (really, go there, it's an excellent images).

At the same time, people for the first time in ages are considering a wide array of consumer goods to be unnecessary. And we're starting to consider that sound financial advice might not just be to cut corners, but to live entirely on a smaller footprint.

Now if only the economic system didn't require reduced consumerism to have recessionary effects.

Monday, June 21, 2010

Oil Nuggets

Cleaning off oil-soaked birds is better PR for BP than it is for the birds. 99% of cleaned birds will die quickly, usually within seven days, usually from kidney or liver damage. Dying after being cleaned, however, would remove BP from any liability under the Migratory Bird Treaty Act of 1918, which would fine the corporation up to $500,000 for the death of a brown pelican.

How much oil has spilled into the gulf? Less than regularly spills into the ocean near Nigeria every year. 40% of American oil importation is from this region, and the environmental effects have reduced the life expectancy of its rural communities to 40 years. Needless to say, our price at the pump has not internalized that cost. Perhaps we as Americans would internalize it more if there were media coverage of events like this, but I'm not that optimistic.

Why else should gas cost more? Because it reduces drunk driving crashes.

Saturday, June 19, 2010

What Should (and Could) Happen.

I think that one covert purpose of this video is to get us used to seeing her in that oval office set.

Anyway, Robert Reich thinks that maybe there could be a careful strategy to get a carbon tax implemented.

Also, Scott Adams reflects on the inverse perspective of our often-repeated refrain – that BP is merely keeping its duty to their shareholders in mind – by revealing his own strategy of buying stock in the most hated companies. If they're externalizing costs (such as by making a whole nation/planet cope with a deteriorated environment), they're probably doing wonders for shareholders' bottom line:

I hate BP, but I admire them too, in the same way I respect the work ethic of serial killers. I remember the day I learned that BP was using a submarine…with a web cam…a mile under the sea…to feed live video of their disaster to the world. My mind screamed "STOP TRYING TO MAKE ME LOVE YOU! MUST…THINK…OF DEAD BIRDS TO MAINTAIN ANGER!" The geeky side of me has a bit of a crush on them, but I still hate them for turning Florida into a dip stick.

Apparently BP has its own navy, a small air force, and enough money to build floating cities on the sea, most of which are still upright. If there's oil on the moon, BP will be the first to send a hose into space and suck on the moon until it's the size of a grapefruit. As an investor, that's the side I want to be on, with BP, not the loser moon.

It's hard to tell to what extent he's being satirical.

Friday, June 18, 2010

Beyond a basic sustenance level, of course.

Aside from payment being vastly misunderstood as an incentive – that greater payment results in no greater output when the task requires creative or cognitive ability – it turns out that it might just make you plain old less happy:

In a sample of working adults, wealthier individuals reported lower savoring ability (the ability to enhance and prolong positive emotional experience). Moreover, the negative impact of wealth on individuals’ ability to savor undermined the positive effects of money on their happiness... This article presents evidence supporting the widely held but previously untested belief that having access to the best things in life may actually undercut people’s ability to reap enjoyment from life’s small pleasures.

Thursday, June 17, 2010

"Better Land Use = Less Oil Use"

Smart Growth America agrees that designing our cities better will reduce our oil consumption:

But they don't quite get to talking about why our cities sprawl this way. Fred Harrison describes a little of how the tax structure results in poor infrastructure and, ultimately, poverty.

It's also worth reading Matt Yglesias's short post on our misplaced priorities:

Preventing Terrorism, if successful, reduces deaths from terrorism. Removing our energy/transport infrastructure from oil dependence can reduce auto deaths, and perhaps make the middle east a slightly less valuable land to divide and conquer. Change the tax structure, and you can reduce poverty (which will then leave fewer people driven to drastic measures to change their lot in life), fix our infrastructure, and thus reduce both auto and terrorism deaths. Maybe I should make a chart.

Almost any development in a central location is likely to generate less automobile travel than the best-designed, compact, mixed-use development in a remote location.

Encouraging growth in our town and city cores and discouraging sprawling growth way out at the edges means less automobile travel. Fewer miles in cars each day means less oil use. Less oil use means….you see where this is going, right?

But they don't quite get to talking about why our cities sprawl this way. Fred Harrison describes a little of how the tax structure results in poor infrastructure and, ultimately, poverty.

It's also worth reading Matt Yglesias's short post on our misplaced priorities:

Obviously you couldn’t reduce [auto fatalities] to zero without totally eliminating motor vehicles, but even ten percent of that number is more people than died on 9/11. And yet the difference between the resources you can mobilize for “cut driving fatalities by ten percent a year” and “help stop another 9/11″ is enormous.

Preventing Terrorism, if successful, reduces deaths from terrorism. Removing our energy/transport infrastructure from oil dependence can reduce auto deaths, and perhaps make the middle east a slightly less valuable land to divide and conquer. Change the tax structure, and you can reduce poverty (which will then leave fewer people driven to drastic measures to change their lot in life), fix our infrastructure, and thus reduce both auto and terrorism deaths. Maybe I should make a chart.

Wednesday, June 16, 2010

Who's responsible?

BP owns the deepwater horizon offshore rig. Halliburton may have done a shoddy cementing job. Americans have paid oil companies for over twenty million barrels of oil per day. And, of course, BP is legally bound to their shareholders to obtain it at minimal cost. If you drive a car or keep a retirement fund, it is very likely that some of your money was part of BP's incentive structure to do a poor job.

Does this mean that all Americans should be held liable for the cleanup cost, as John Boehner and the US Chamber of Commerce suggests?

I can't help but feel outrage at the presumptuousness, but I imagine that I have been liable, as have most Americans, paying into the oil market to give me cheap gasoline. If our federal tax system wasn't so closely dependent on income taxes, I might sympathize with Boehner a little more.

UPDATE: Tom Friedman agrees. But then again, he's a "barely literate cartoon mustache of oversimplification whose understanding of global politics is slightly less comprehensive than a USA Today infographic and who possesses about as much insight into world events as a lightly vandalized Wikipedia stub entry."

Does this mean that all Americans should be held liable for the cleanup cost, as John Boehner and the US Chamber of Commerce suggests?

I can't help but feel outrage at the presumptuousness, but I imagine that I have been liable, as have most Americans, paying into the oil market to give me cheap gasoline. If our federal tax system wasn't so closely dependent on income taxes, I might sympathize with Boehner a little more.

UPDATE: Tom Friedman agrees. But then again, he's a "barely literate cartoon mustache of oversimplification whose understanding of global politics is slightly less comprehensive than a USA Today infographic and who possesses about as much insight into world events as a lightly vandalized Wikipedia stub entry."

Tuesday, June 15, 2010

Nuclear Energy

Below is an excellent debate on nuclear energy. After viewing, it seems like our current nuclear technology is a much better option than our coal/oil infrastructure, but not nearly as good as full reliance on renewables. Practically, I imagine that we will have to rely on more nuclear plants in the short term. As Cambridge Physicist David McKay was quoted in the film, "I'm not trying to be pro-nuclear, I'm just pro-arithmetic."

That being said, I'm fully sure that powering reactors for energy infrastructure is a much better use of the uranium than for warheads. As mentioned briefly in the film, Megatons to Megawatts has been dismantling warheads and downgrading the uranium for use in power plants.

That being said, I'm fully sure that powering reactors for energy infrastructure is a much better use of the uranium than for warheads. As mentioned briefly in the film, Megatons to Megawatts has been dismantling warheads and downgrading the uranium for use in power plants.

Monday, June 14, 2010

If you do it to yourself, is it an externality?

There has been brief discussion of taxing soda in an effort to pay for health care costs. There is some intrinsic sense to this, that the high sugar content puts you at greater risk of developing diabetes or obesity, and that the tax would prevent some people from developing the habits that lead to the diseases and pay for the treatment of those who are not deterred.

Strictly speaking, this is not an externality. The negative effects of the sugar overconsumption are primarily borne by the individual, not the community (though I might argue for a theory that would imply greater interconnectedness than most economists', I'll give them the benefit of the doubt for the sake of discussion). The word "internality" was anonymously proposed as a name for this effect, the negative effects with which we unexpectedly burden our future selves. The community bears the costs not essentially, but only when we've chosen to socialize medicine, wholly or in part, i.e.:

Mankiw asks, however, "To what extent should we view the future versions of ourselves as different people from ourselves today?" i.e., is it right to correct our near-sighted cognitive biases with taxes, to make you internalize the cost you will bear in the future today? Should the additional tax reflect the future cost, or merely our bias in understanding the future cost?

Even if this is not practical, it might be of benefit to our quality of life to try. Certainly, as Mankiw agreed, we should start by eliminating corn subsidies first, rather than taxing the products that contain its high-fructose syrup.

Strictly speaking, this is not an externality. The negative effects of the sugar overconsumption are primarily borne by the individual, not the community (though I might argue for a theory that would imply greater interconnectedness than most economists', I'll give them the benefit of the doubt for the sake of discussion). The word "internality" was anonymously proposed as a name for this effect, the negative effects with which we unexpectedly burden our future selves. The community bears the costs not essentially, but only when we've chosen to socialize medicine, wholly or in part, i.e.:

A third type of externality is a governmental financing externality, in which the activity of some people impose a cost on others because they are forced to pay taxes to pay for that activity. That applies to the consumption of unhealthy food when taxpayers pay for the medical costs.

Mankiw asks, however, "To what extent should we view the future versions of ourselves as different people from ourselves today?" i.e., is it right to correct our near-sighted cognitive biases with taxes, to make you internalize the cost you will bear in the future today? Should the additional tax reflect the future cost, or merely our bias in understanding the future cost?

Even if this is not practical, it might be of benefit to our quality of life to try. Certainly, as Mankiw agreed, we should start by eliminating corn subsidies first, rather than taxing the products that contain its high-fructose syrup.

Saturday, June 12, 2010

If you had doubts that our current car-based, suburban version of the American Dream wasn't something that was heavily lobbied, you could also read about how the Reagan administration prevented you from driving more safely:

All that ended in January 1981, when the "Morning in America" team from the Reagan administration halted the RSV [Research Safety Vehicles] work...

After exploring whether the Smithsonian wanted any of the RSV cars (they did), NHTSA revealed under a Freedom of Information Act query that it had quietly sent all remaining cars to be destroyed. On July 1, 1991, the RSV showcar was crashed into a barrier at 50 mph with no dummies inside, and its airbags shut off.

Then-NHTSA chief Jerry Curry contended the vehicles were obsolete, and that anyone who could have learned something from them had done so by then. Claybrook, the NHTSA chief who'd overseen the RSV cars through 1980, told Congress the destruction compared to the Nazis burning books.

"Junking those cars was a terrible idea," said Kelley, who now teaches at Tufts medical school. "What is the benefit of keeping anything that's historically important? The future wants to know more about the past, and when you destroy the past, you destroy the future's access to knowing about it."

"I thought they were intentionally destroying the evidence that you could do much better," said Friedman.

Friday, June 11, 2010

Found in your Wonkette.

And if that doesn't speak for itself, you can read Steven Pearlstein's endorsement of ending our national war on regulation.

And if that doesn't speak for itself, you can read Steven Pearlstein's endorsement of ending our national war on regulation.

Thursday, June 10, 2010

Deepwater Horizon Digest

We shouldn't be to surprised to discover that oil companies pay millions to lease tracts of the gulf. Mother Jones attempts some indignation – "Where most people look at the Gulf, they see a vast marine ecosystem, wetlands, and, until recently, gorgeous beaches" – I find it difficult to be surprised when we've treated all our land-based natural resources this way for the entirety of our country's history. My question, which I couldn't seem to find addressed in the Mother Jones article, is: who is the recipient of the payments in these leases, as high as 53 million dollars? From whom do they lease?

Robert Reich continues to defend the idea that Obama should take over BP's American operation, specifically responding to the charge that, since the problem is not something that can be solved right away, it would be a political folly to take ownership of the mess when the conclusion is so far away. And true, it is a worrisome prospect to put the government in charge when many Americans are distrustful of government takeovers. My personal take at the moment would be closer to Reich's, that BP is still responding in the way that maximizes shareholder value. The government is answerable to its citizens – at least in theory – BP holds no such pretense.

Reich also suggests that BP should be required to hire unemployed youth to clean up the spill. BP, instead, is spending money trying to pick up some of your search results, undoubtedly so they can show you misleading charts.

If there isn't enough incentive already to tax carbon (or otherwise shift energy sources), evidence has been found that the presence of the industry enforces patriarchy:

Speaking of gender norms, comedic genius Sarah Palin suggests in a post titled "Less Talkin', More Kickin'" that Obama should solve the oil leak by talking to a few more people, including all of Tony Hayward, "experts," and, um, her.

Robert Reich continues to defend the idea that Obama should take over BP's American operation, specifically responding to the charge that, since the problem is not something that can be solved right away, it would be a political folly to take ownership of the mess when the conclusion is so far away. And true, it is a worrisome prospect to put the government in charge when many Americans are distrustful of government takeovers. My personal take at the moment would be closer to Reich's, that BP is still responding in the way that maximizes shareholder value. The government is answerable to its citizens – at least in theory – BP holds no such pretense.

Reich also suggests that BP should be required to hire unemployed youth to clean up the spill. BP, instead, is spending money trying to pick up some of your search results, undoubtedly so they can show you misleading charts.

If there isn't enough incentive already to tax carbon (or otherwise shift energy sources), evidence has been found that the presence of the industry enforces patriarchy:

Oil production reduces the number of women in the labor force, which in turn reduces their political influence. As a result, oil-producing states are left with atypically strong patriarchal norms, laws, and political institutions.

Speaking of gender norms, comedic genius Sarah Palin suggests in a post titled "Less Talkin', More Kickin'" that Obama should solve the oil leak by talking to a few more people, including all of Tony Hayward, "experts," and, um, her.

There is no economic magic...

Just as with the compulsion to lie to children and make them believe in a magical gift giver, a belief in economic magic, and government as gift giver, is deeply embedded in our culture. Most people are blindly culture bound, so they are invulnerable to economic logic. Few people, even social scientists, can transcend their culture, and so pernicious cultural practices persist. Thus disasters such as war, the Great Depression, and the giant oil spill in the Gulf of Mexico.From Fred Foldvary

Wednesday, June 9, 2010

Economic policy has not kept up with the science of motivation and happiness.

After viewing this, it makes perfect sense that paying volunteers reduces their volunteerism. On top of it, when you learn that our dissatisfaction and subsequent desire for more money is based on how much money our peers have, or that even high school popularity (a notoriously fickle business) has a demonstrable effect on our financial success, it sort of makes you want to ensure our economic system relies a little less on free market incentives in which we're susceptible to all sorts of cognitive biases and environmental factors. At least one of those biases – in this case, committing to a situation with sunken costs – diminish with age.

Tuesday, June 8, 2010

Infographic

Be sure to check out this NYT inforgraphic to learn where the oil has gone, the destruction it's causing, and what has been tried to stop it.

Monday, June 7, 2010

We are still in a recession

Job numbers are poor, and the stimulus that wasn't big enough in the first place has been spent.

We're still in a liquidity trap, as this chart from Greg Mankiw illustrates what the interest rate should be, compared to what it is.

(That leveling out in the past year is right around a federal interest rate of zero, hence the trap.) A corporatist drumbeat is beginning that we should start to raise the interest rate, out of fear of inflation, even though that isn't really a risk at all right now, deflation is.

Likewise, the tea party and libertarians don't want any more stimulus because they think we're too far in debt already, (though no one actually wants to cut anything from the budget, and taxes are of course anathema) but it's pretty easily demonstrated that we can handle more debt than we already have.

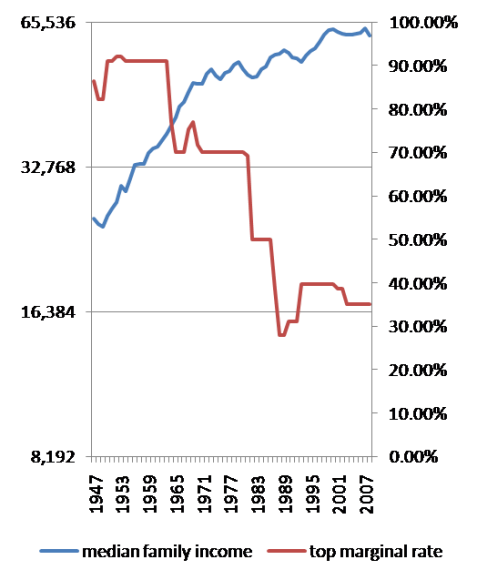

Not that we'd even have too big a problem raising taxes now, because the top income tax rate has never been lower (not that income tax is the only reasonable means for revenue, as frequent readers may note). And, contrary to the corporatist drumbeat, it would likely have an expansionary effect, as Paul Krugman's chart to the right shows, a high top income tax rate has the greatest rate of expansion, and that if you lower taxes on the rich, growth slows, i.e., Ayn Rand was way wrong about that Galt character.

In the short term, we need more stimulus immediately. It should be paid for shortly thereafter by higher taxes – on high income for expansion and upward mobility, and on land and carbon to save the planet and improve our lives. Robert Gibbs could say something like this.

In the long term, I'm not sure we could survive without an entirely new economic system.

We're still in a liquidity trap, as this chart from Greg Mankiw illustrates what the interest rate should be, compared to what it is.

(That leveling out in the past year is right around a federal interest rate of zero, hence the trap.) A corporatist drumbeat is beginning that we should start to raise the interest rate, out of fear of inflation, even though that isn't really a risk at all right now, deflation is.

Likewise, the tea party and libertarians don't want any more stimulus because they think we're too far in debt already, (though no one actually wants to cut anything from the budget, and taxes are of course anathema) but it's pretty easily demonstrated that we can handle more debt than we already have.

Not that we'd even have too big a problem raising taxes now, because the top income tax rate has never been lower (not that income tax is the only reasonable means for revenue, as frequent readers may note). And, contrary to the corporatist drumbeat, it would likely have an expansionary effect, as Paul Krugman's chart to the right shows, a high top income tax rate has the greatest rate of expansion, and that if you lower taxes on the rich, growth slows, i.e., Ayn Rand was way wrong about that Galt character.

In the short term, we need more stimulus immediately. It should be paid for shortly thereafter by higher taxes – on high income for expansion and upward mobility, and on land and carbon to save the planet and improve our lives. Robert Gibbs could say something like this.

In the long term, I'm not sure we could survive without an entirely new economic system.

Saturday, June 5, 2010

Friday, June 4, 2010

More on BP.

A Petroleum engineer describes how BP is doing the minimum to clean up (as expected) and suggests what they should be doing. His suggestions summarized:

- Stop releasing dispersants.

- Mobilize every possible tanker to siphon up crude from as close to the leak points as possible.

- Restart work on the second pressure relief well.

Robert Reich discusses how it is both possible and necessary for BP to be placed under temporary receivership of the U.S. government. His reasons (summarized, again) why it must be done:

- We are not getting the truth from BP.

- We have no way to be sure BP is devoting enough resources to stopping the gusher.

- BP’s new strategy for stopping the gusher is highly risky.

- Right now, the U.S. government has no authority to force BP to adopt a different strategy.

- The President is not legally in charge.

One thing that kind of bugs me about the public response to the disaster is the idea that we can punish the BP corporation by not shopping at the BP gas station and instead shopping at the gas station across the street. BP's profit is determined largely by the cost of oil on a globally traded market, and boycotts of individual gas stations will tend to cause more harm to the proprietor of the station (and the benefit will largely be to the station across the street) than to the corporation at large. If you really want to cut into the BP's profits, you need to cut into the entire oil industry.

In addition to the more obvious pigouvian incentive of the carbon tax, a land tax will also reduce our overall oil consumption:

We spend a lot of money heating and cooling older homes many miles from where people actually work. People commute long distances -- most of them via private cars because there aren't viable alternatives. Why do they live so far from their work? Usually because they can't afford to live closer.

The selling price of most housing within a commutable distance of any vibrant city is mostly land value. And most people don't know it.

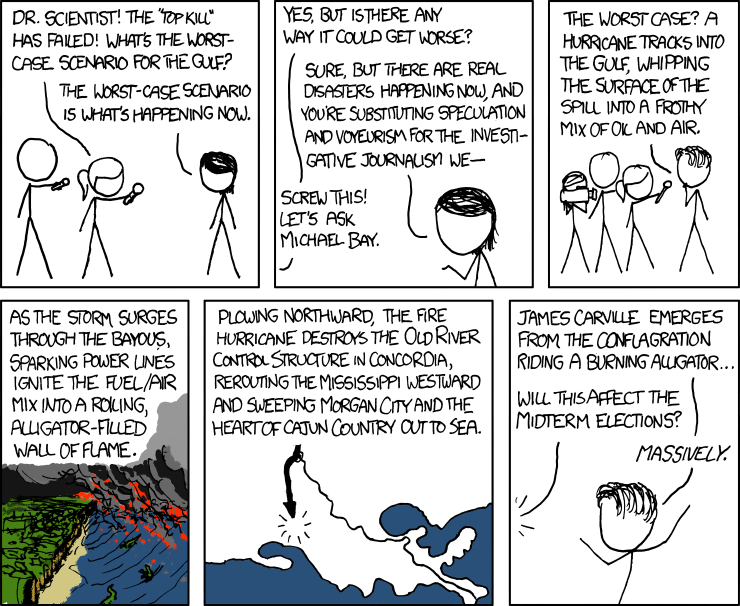

Also, xkcd speculates on the worst case scenario:

Click to enlarge, there's a hurricane of fire and alligators.

Oh, and as long as we've made it to the comedic section of this post, you can also read about how Sarah Palin is trying to reconcile this disaster with the "Drill, Baby, Drill" slogan, because it's funny.

Subscribe to:

Posts (Atom)