We examine whether advertising increases household debt by studying the initial expansion of television in the 1950's. Exploiting the idiosyncratic spread of television across markets, we use micro data from the Survey of Consumer Finances to test whether households with early access to television saw steeper debt increases than households with delayed access. Results indicate that exposure to television advertising increases the tendency to borrow for household goods and the tendency to carry debt. Television access is associated with higher debt levels for durable goods, but not with the total amount of non-mortgage debt. We provide suggestive evidence that increased labor supply may drive our results. The role of media in household debt may be greater than suggested by existing research.

Friday, October 22, 2010

TV advertising induces consumer debt?

From Bakadesuyo:

Wednesday, October 20, 2010

De-Mankiw

I like Greg Mankiw because, among conservatives, he's reasonable. The problem, however, with providing reasoning for opinions is that one can now argue against them.

From his recent NYT Op-Ed:

This is all correct, but his premise illustrates the first problem. The reason why we're not concerned about the wealthy (as he puts it, "almost completely sated") getting a big tax cut is because they can afford to save it. Saving is good, but it's not an economic stimulus. Give the same size of tax cut to someone who is in far greater need, and the person will spend it soon, and in aggregate, generate jobs.

After summarizing all the taxes that would impact this previous situation, his conclusion:

This is all also correct. But again: is this a problem? You are "almost completely sated." If you turn down the offer to write an article, then someone else gets that same offer. If all the people who are almost completely sated (as well as the completely sated ones) find the offer equally unimpressive, the person accepting the offer to write the article will almost certainly be in a position to spend it sooner and stimulate the economy, as well as advance his or her own career.

This too is correct, but has an implied fear tactic. The subtext is, "tax your doctor too much and you won't get any health care!" There are, however, plenty of capable people who want to do these jobs, who are just waiting for others to step out of the way.

From his recent NYT Op-Ed:

Suppose that some editor offered me $1,000 to write an article. If there were no taxes of any kind, this $1,000 of income would translate into $1,000 in extra saving. If I invested it in the stock of a company that earned, say, 8 percent a year on its capital, then 30 years from now, when I pass on, my children would inherit about $10,000. That is simply the miracle of compounding.

This is all correct, but his premise illustrates the first problem. The reason why we're not concerned about the wealthy (as he puts it, "almost completely sated") getting a big tax cut is because they can afford to save it. Saving is good, but it's not an economic stimulus. Give the same size of tax cut to someone who is in far greater need, and the person will spend it soon, and in aggregate, generate jobs.

After summarizing all the taxes that would impact this previous situation, his conclusion:

HERE’S the bottom line: Without any taxes, accepting that editor’s assignment would have yielded my children an extra $10,000. With taxes, it yields only $1,000. In effect, once the entire tax system is taken into account, my family’s marginal tax rate is about 90 percent. Is it any wonder that I turn down most of the money-making opportunities I am offered?

This is all also correct. But again: is this a problem? You are "almost completely sated." If you turn down the offer to write an article, then someone else gets that same offer. If all the people who are almost completely sated (as well as the completely sated ones) find the offer equally unimpressive, the person accepting the offer to write the article will almost certainly be in a position to spend it sooner and stimulate the economy, as well as advance his or her own career.

Perhaps you wish that your favorite singer would have a concert near where you live. Or, someday, you may need treatment from a highly trained surgeon, or your child may need braces from the local orthodontist. Like me, these individuals respond to incentives. (Indeed, some studies report that high-income taxpayers are particularly responsive to taxes.) As they face higher tax rates, their services will be in shorter supply.

This too is correct, but has an implied fear tactic. The subtext is, "tax your doctor too much and you won't get any health care!" There are, however, plenty of capable people who want to do these jobs, who are just waiting for others to step out of the way.

Monday, October 18, 2010

Though I am in fact a Dan Ariely fan.

I happened upon the original paper that was recently reported on in a number of locations, including here.

After reading the survey method, the declared results seem even more dubious. The participants were given three choices of wealth distribution: Perfectly equitable, Sweden's, and the USA's. These weren't marked with these titles, but merely indicated the percentage of wealth controlled by each quintile. People overwhelmingly chose the Swedish distribution, without knowing it.

More reasonable than "everyone wants Swedish wealth distribution" is "people were given two extremes and a moderate option, and they chose the moderate option."

The latter experiment as a little better, in that people could freely offer numbers. However (as previously mentioned) people may not be very good at thinking about the economy in terms of percent of wealth controlled by quintile. It's also not clear if the experiment was done on the same subjects in the same survey, because seeing Sweden's wealth distribution numbers in a context as the moderate distribution could inform the subject's later responses when given a blank to fill in.

Again, I'm not arguing for an inequitable distribution of wealth, just sensible survey methods. Wealth distribution should be more equitable not because everyone agrees to want it, but because the economy and society will be healthier if it is.

After reading the survey method, the declared results seem even more dubious. The participants were given three choices of wealth distribution: Perfectly equitable, Sweden's, and the USA's. These weren't marked with these titles, but merely indicated the percentage of wealth controlled by each quintile. People overwhelmingly chose the Swedish distribution, without knowing it.

More reasonable than "everyone wants Swedish wealth distribution" is "people were given two extremes and a moderate option, and they chose the moderate option."

The latter experiment as a little better, in that people could freely offer numbers. However (as previously mentioned) people may not be very good at thinking about the economy in terms of percent of wealth controlled by quintile. It's also not clear if the experiment was done on the same subjects in the same survey, because seeing Sweden's wealth distribution numbers in a context as the moderate distribution could inform the subject's later responses when given a blank to fill in.

Again, I'm not arguing for an inequitable distribution of wealth, just sensible survey methods. Wealth distribution should be more equitable not because everyone agrees to want it, but because the economy and society will be healthier if it is.

Friday, October 15, 2010

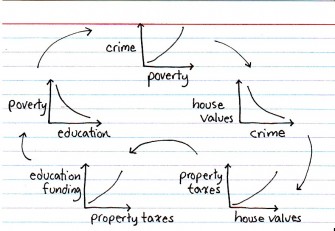

Education, poverty, crime, property

From Indexed.

Some of the comments indicate that a missing (and erroneous) chart would be the one showing a correlation between education funding and education. And, of course, there's the matter of to what extent public-work-induced housing value increases have been reclaimed in public revenue.

Some of the comments indicate that a missing (and erroneous) chart would be the one showing a correlation between education funding and education. And, of course, there's the matter of to what extent public-work-induced housing value increases have been reclaimed in public revenue.

Friday, October 8, 2010

As I'm sure you're aware...

From bakadesuyo:

My estimates imply that 8% of the rise in obesity between 1979 and 2004 can be attributed to the concurrent drop in real gas prices, and that a permanent $1 increase in gasoline prices would reduce overweight and obesity in the United States by 7% and 10%.

Wednesday, October 6, 2010

Check out Smart Growth America's criticism of the Travel Time Index:

the Travel Time Index actually gets daily driving backwards: cities with longer daily driving times look better that those with shorter driving times. Why? The Index leaves out something just about any traveler knows to think about: distance. By focusing only on speeds, the TTI neglects what people actually care about: how long does it take me to get there?

See the report at CEOs for Cities.

Monday, October 4, 2010

Economic Ideal, or Human Error.

A few people have passed around Matthew Yglesias's post about Americans' estimates of wealth distribution, in which people are asked to report both their ideal distribution and their perception of the actual distribution.

One thing I suspect might be happening that wasn't discussed: people may not be great at calculating distribution in this way. Perhaps people should be asked as well, "What do you think the average individual's wealth is in this highest (or lowest) quintile to create this distribution?" It seems like a simple enough math problem, but through the course of this survey, it's likely participants weren't doing it. People have much greater familiarity with a concrete bank account price tag than they do with percent of the nation's wealth controlled.

This is not, however, an argument for the status quo. At the very least, the report does indicate that people want much more equitable distribution than they think we have, even as that is far less equitable than what we actually have!

One thing I suspect might be happening that wasn't discussed: people may not be great at calculating distribution in this way. Perhaps people should be asked as well, "What do you think the average individual's wealth is in this highest (or lowest) quintile to create this distribution?" It seems like a simple enough math problem, but through the course of this survey, it's likely participants weren't doing it. People have much greater familiarity with a concrete bank account price tag than they do with percent of the nation's wealth controlled.

This is not, however, an argument for the status quo. At the very least, the report does indicate that people want much more equitable distribution than they think we have, even as that is far less equitable than what we actually have!

Subscribe to:

Posts (Atom)